Introduction

Venture capital is dynamic; the industry's heartbeat is the ability to anticipate and adapt to emerging trends. However, to predict where we’re headed, it is, of course, essential to understand past patterns and trends. This report analyzes Q3 2023 venture funding rounds.

Looking at Q3 2023 data, it is clear that the current economic conditions, from rising interest rates to battles against inflation, have impacted funding. The numbers show fewer funding rounds and a decline in total capital raised.

But it is not all doom and gloom. Many funds have capital on hand; they are just more cautious and diligent about where they place it. There is a clear flock to quality – both in terms of startups and investors.

In the following analysis of the venture landscape for Q3 2023, the data is collected from Crunchbase. The funding rounds only include U.S.-based investments and stages Pre-Seed through to Series C.

Summary

Continued pullback in the number of funding rounds and amount raised across Pre-Seed to Series-C stages.

38% year-over-year decrease in funding across all stages and a 36% decrease in the total number of funding rounds.

The Seed to Series A graduation rates declined, dropping from 23% in 2023 to 5% for the 2022 cohort.

AI startups experienced increased funding, primarily limited to the Seed and Series-B stages.

16% year-over-year increase in funding, driven by Seed and Series-B investments.

61.77% increase in Seed stage funding; 44.57% increase in Series-B funding.

Total funding rounds and amount raised

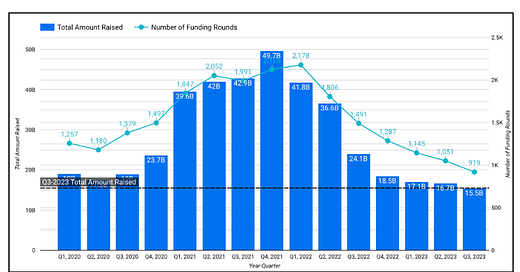

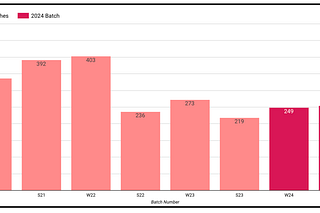

The graph below illustrates a significant tightening of the venture capital landscape, with a 38% year-over-year decrease in funding across funding rounds and 36% decrease in the number of funding rounds.

Note, funding rounds included in this analysis are Pre-Seed, Seed, Series A, Series B, and Series C.

Investment Type Breakdown: Total funding rounds and amount raised

The table displays funding rounds and the amount raised for venture stages in Q3-2023 compared to previous periods on a quarter-over-quarter and year-over-year basis.

TL;DR – venture funding is down year-over-year across all stages. For quarter over quarter, there is a mixed scene where Seed stage saw a minor increase of 4.29% in the amount raised, while other stages like Pre-Seed, Series-A, Series-B, and Series-C saw a decline in both the number of rounds and the amount raised.

The most drastic reductions in the number of funding rounds are at the Pre-Seed and Series-A stages, decreasing by 26.42% and 17.25% quarter-over-quarter, respectively, while the amount raised at the Series-A stage saw a sharp decrease of 21.77% quarter-over-quarter indicating that is still a challenging environment for Series-A.

Artificial Intelligence: Total funding rounds and amount raised

Since ChatGPT was introduced last November, there’s been (of course) a massive jump in interest in artificial intelligence. This has led to many new AI products and startups entering the market.

When we look at the numbers, AI funding has increased by 16% compared to last year. This is a positive sign, especially when general funding decreased by 38%. But it’s surprising to see the number of funding rounds for AI startups decrease by 11% year-over-year.

Note “artificial intelligence” category is defined by Crunchbase. It is not a perfect categorization, and here, we do not distinguish artificial intelligence and machine learning companies from generative artificial intelligence companies.

Artificial intelligence, Investment Type Breakdown: Total funding rounds and amount raised

In this section, we’re looking at funding for companies categorized as “Artificial Intelligence” by Crunchbase and breaking the data down by investment type.

The data shows that the Seed stage number of investing rounds has grown by 21.13% year over year and the total amount of invested capital 61.77% year over year.

Series B tells a different story. Even though there were fewer Series B funding rounds, the total money invested in these rounds has increased by 44.57%, driven by Genesis Therapeutics’s $200M round led by a16z, Imbue’s $200M funding round, and Enfabrica with $125M in funding.

Round sizes

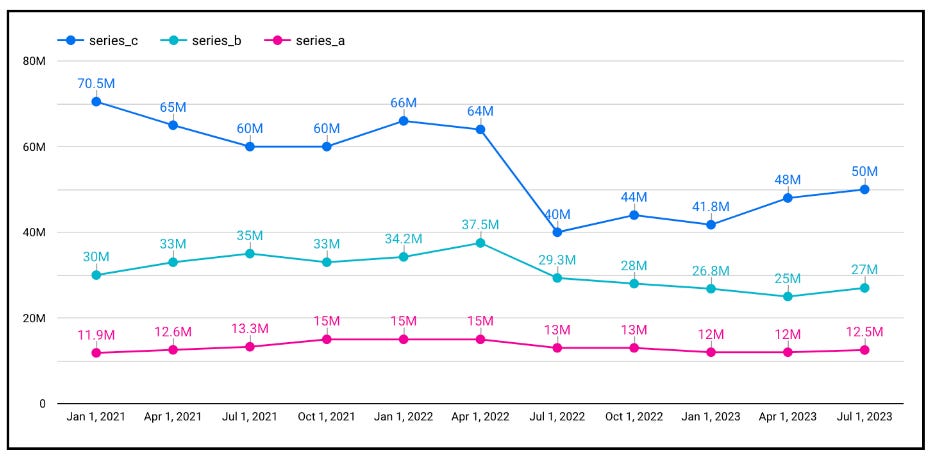

Late-stage round sizes

Looking at round sizes, the median round size for Series A round is $12.5M, $27M for Series B, and $50M for Series C.

Early-stage round sizes

Early-stage round sizes have increased. This shift might be due to later-stage funds now participating in the Seed stage, OR it could be that Seed startups are raising bigger rounds to reach Series A milestones with the current macro environment. Regardless, the median size for a Seed round right now is $3M; Pre-Seed it is $1.5M.

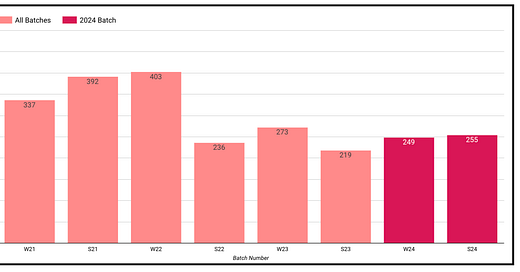

Seed stage graduation rates to Series-A

This section deviates slightly from the Q3-2023 focus; it’s more of a pulse check.

Seed to Series-A graduation rates act as a measure of health and hazard for the Seed ecosystem and reflect the ability of Seed-stage startups to hit their milestones that will attract further investment.

Back in 2020, approximately 23% of Seed-stage startups made it to Series-A within two years. Fast forward to 2022, and the market looks different. Over the past 20 months since the start of 2022, the graduation rates have decreased to 5%. This could be a reflection of companies delaying their fundraising efforts until a later market entry, or it could be fewer companies are reaching Series-A milestones – or both.

All stages: Percentage of funding allocation

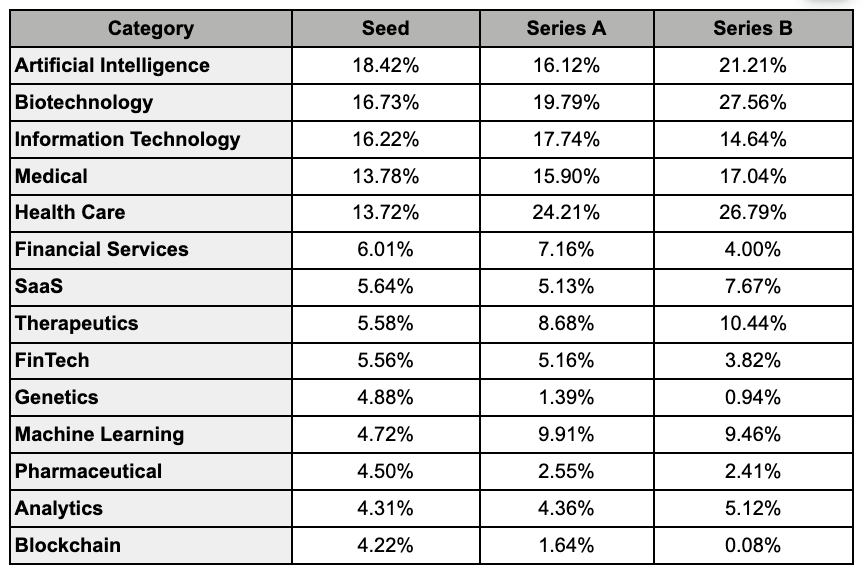

What sectors are people investing in?

The data below displays the percentage of funding per sector across Seed, Series A, and Series B. Reading the data, Artificial Intelligence makes up 18% of all Seed funding in Q3-2023, 16% of all Series-A funding, and 27% of Series B funding.

Biotechnology and Health Care make up a larger portion of the total funding for Series B than for Seed and Series A. This could imply that these sectors are more mature.

Conversely, certain sectors like Blockchain see a decline in funding as a portion of the total amount of funding, which aligns with the notion that the category is still somewhat new.

Thank you for reading!! If you’re interested in connecting — Twitter: https://twitter.com/seidtweets — LinkedIn: https://www.linkedin.com/in/jamesin-seidel-5325b147/

One methodology consideration: I believe Crunchbase defines "Series A" as a round over $5M.

So, large seed rounds are potentially getting incorrectly counted as Series As (vs, say, using a round's legal docs to determine official round, which is not very feasible for CB).

If you assume seed rounds were larger during the peak ZIRP years, then the differences in seed to A may be somewhat exaggerated here.

Probably not by too much, though! I certainly believe the trendlines.