AI is crowded. Founders building in AI and investors investing in AI, wake up every day thinking about how competitive the market is.

That’s why, two years after the ChatGPT-3 launch, I’ve been obsessed with the question: what’s working?

Who is making money?

What startups have broken through? Achieved early product-market-fit?

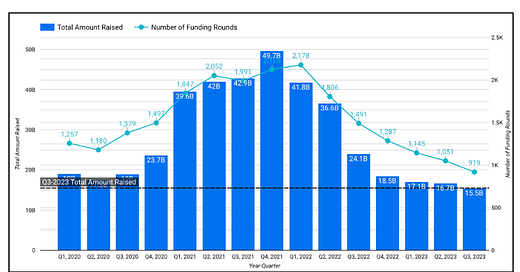

To find answers, I’ve been looking at later-stage data and wanted to share some of the high-level insights.

“Success” and “what’s working,” in this case, are hard to define.

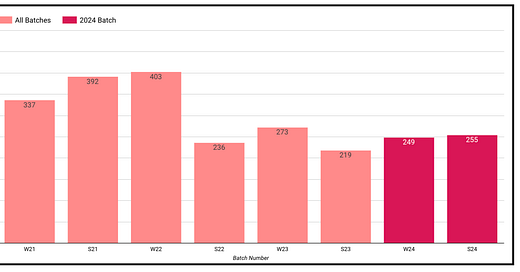

So I settled on a definition to move forward. The analysis includes — startups that have raised a Seed round after ChatGPT-3’s launch and have since raised a Series-A round.

The definition is not perfect. For example, a Seed company might have raised a huge round, making Series A unnecessary for the next five years, etc.

But let’s go with it —

Looking at early-stage AI companies that have raised a Series-A quickly off of the back of their Seed, we see six categories start to take shape:

AI foundational models and infrastructure

AI enterprise and business - tooling

AI enterprise and business - vertical embedded software

AI x some vertical

AI x data infrastructure

AI x engineering

As a data person, I find it annoying when market maps are published without any way to explore the included websites or data.

So — thanks to easy prompting in Cursor (god bless) — I’ve created a simple app that will live as an interactive market map to visualize the data:

» » https://ai-series-a-market-map-dot-chapter-one-340115.uc.r.appspot.com/

The data is pulled from Crunchbase and categorized with models and some manual tweaks. I’ve only included companies in the US and Europe. Note that there is a very good chance I missed some startups on this list. Feel free to reach out if I missed anything, and I can add it to the live site!

Now let’s dig in and show some data —>

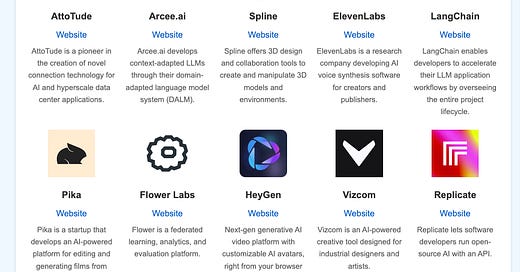

AI Foundation Models / Infrastructure

General themes:

Specialized foundational models (Mistral AI, Twelve Labs)

Domain-specific foundational models (Arcee AI)

Infrastructure for developing & deploying models (Together AI, LangChain, Replicate)

Creative tools and generation (Ideogram, Spline, Vizcom, Pika)

Voice generation (ElevenLabs)

Federated learning (Flower Labs)

Avatar generation (HeyGen)

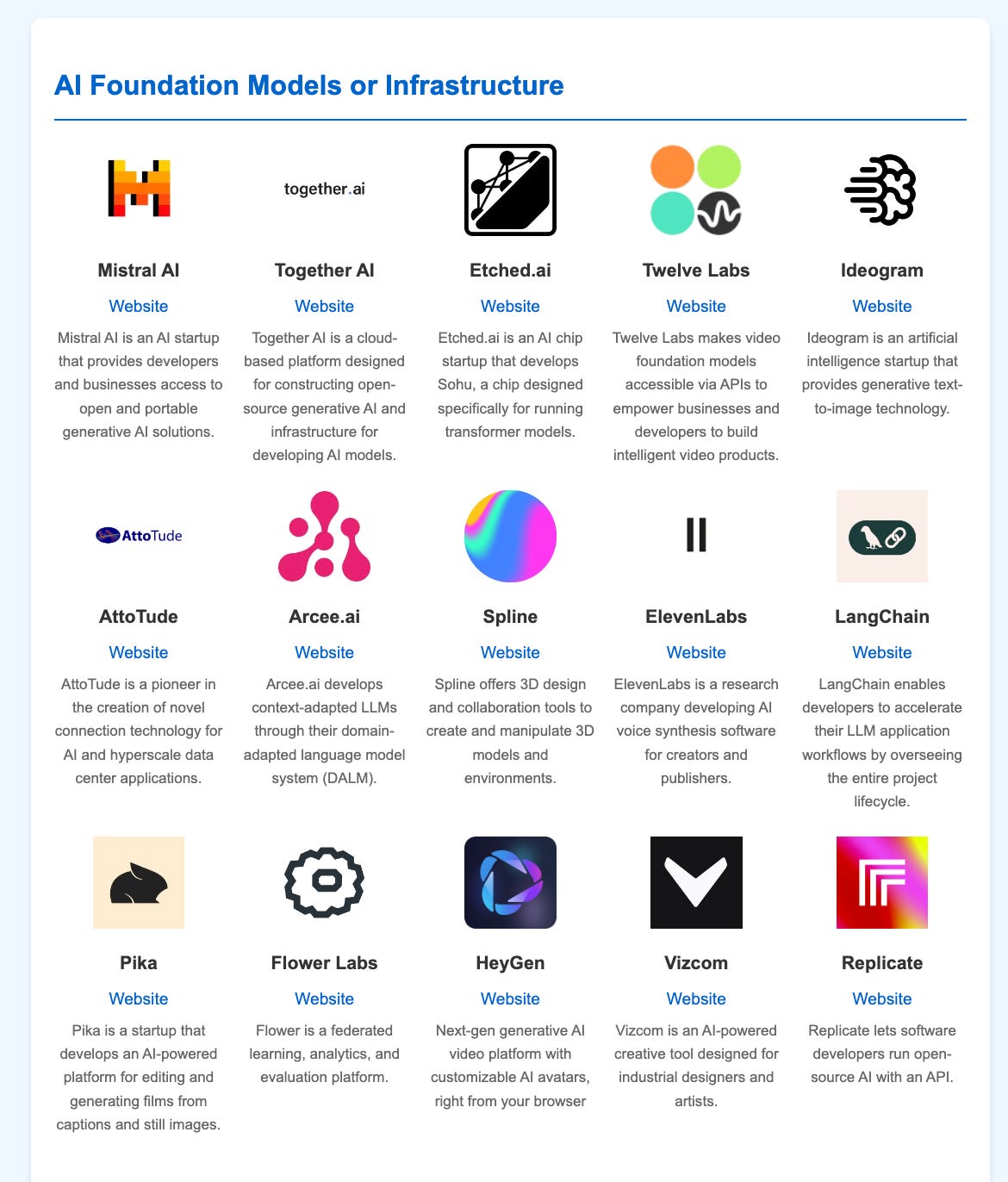

AI Business & Enterprise - Tooling

General themes:

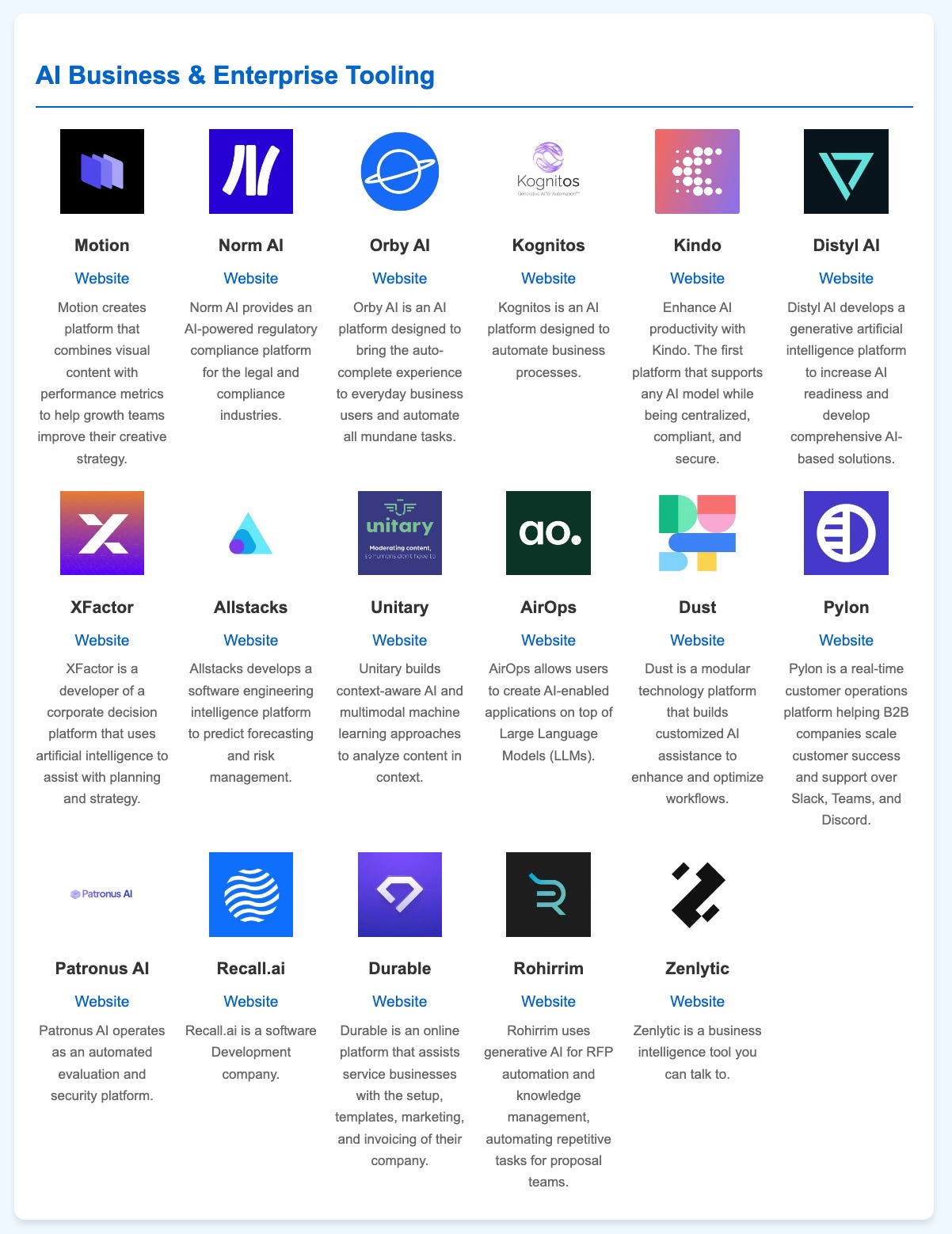

AI Business & Enterprise - Vertical Embedded Software

General themes:

Procurement x AI (LevelPath)

HR x AI (Ema)

Security x AI (DeepKeep, Dropzone AI)

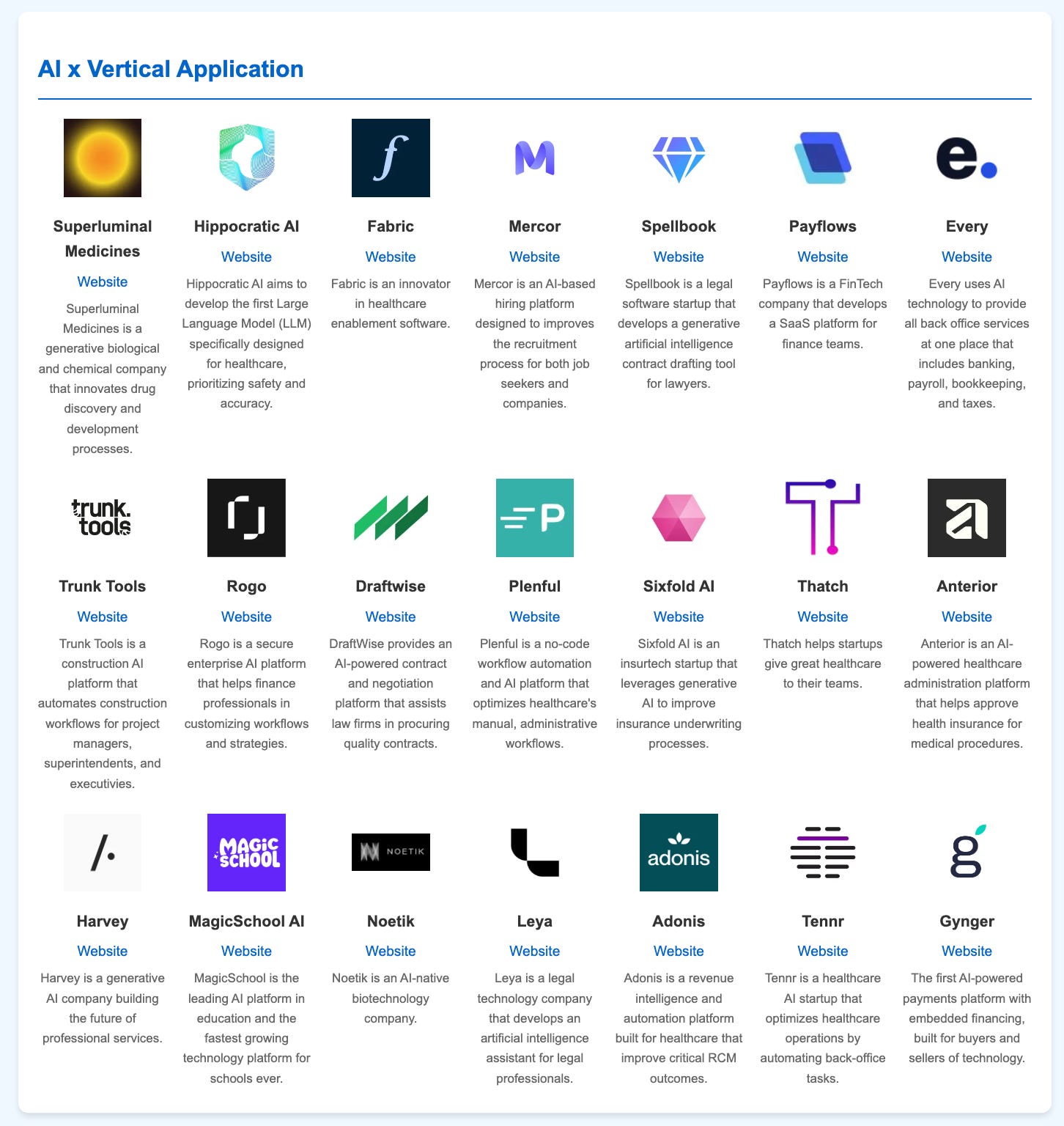

AI x Vertical Applications

General themes:

Healthcare x AI (Superluminal Medicines, Hippocratic AI, Fabric, Plenful, Thatch, Anterior, Adonis, Tennr)

Recruitment x AI (Mercor)

Construction and Manufacturing x AI (Trunk Tools)

Insurance x AI (Sixfold)

Education x AI (MagicSchool)

Biotech x AI (Noetik)

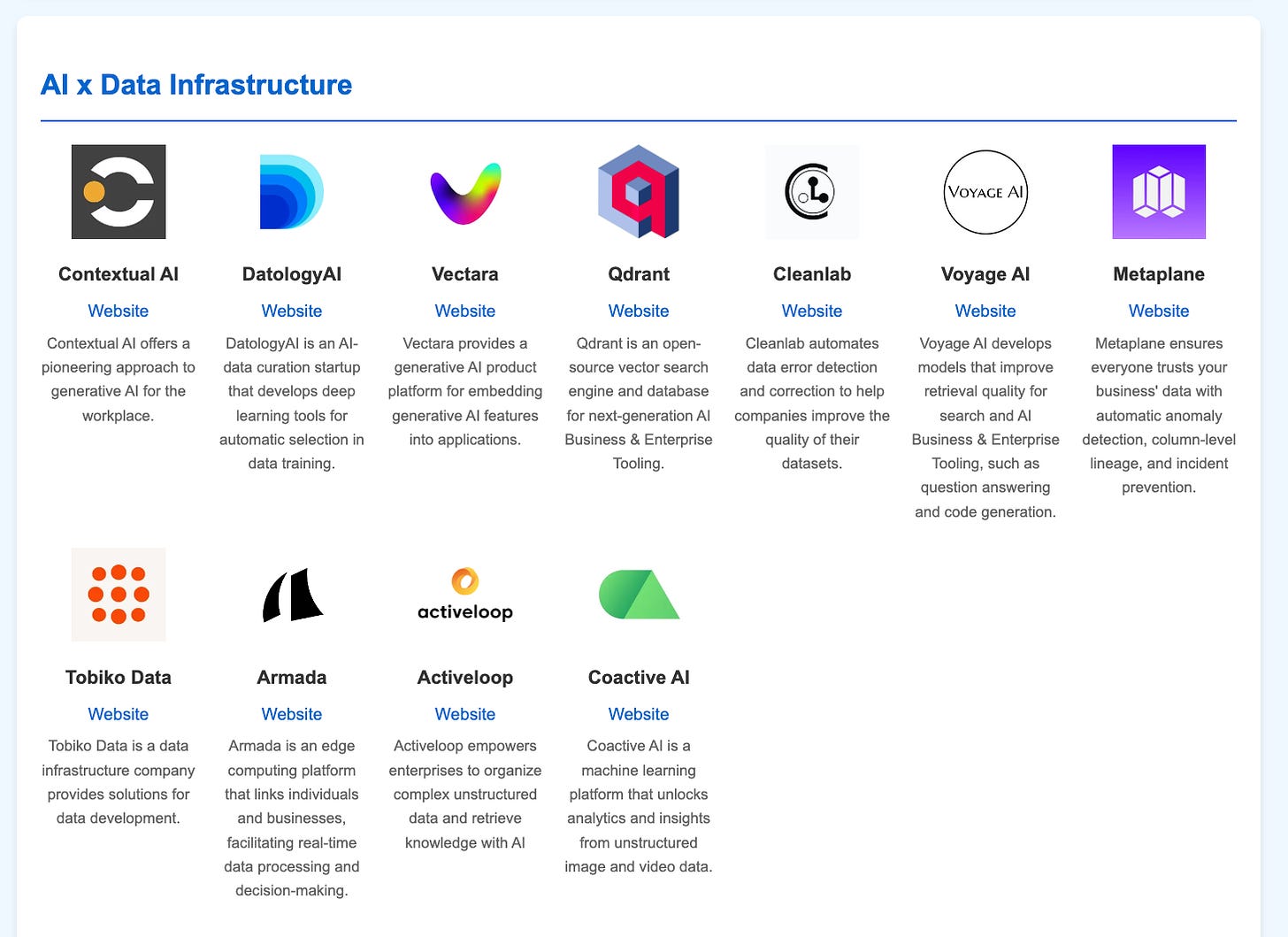

AI x Data Infrastructure

General themes:

Data processing, management and RAG (Contextual AI, Voyage, Tobiko Data, Vectara, ActiveLoop)

Vector search and databases (Qdrant)

Data quality improvement (Cleanlab)

Data training (Dataology AI)

Data observability (Metaplane)

Edge computing (Armada)

Data generation and labeling (Coactive)

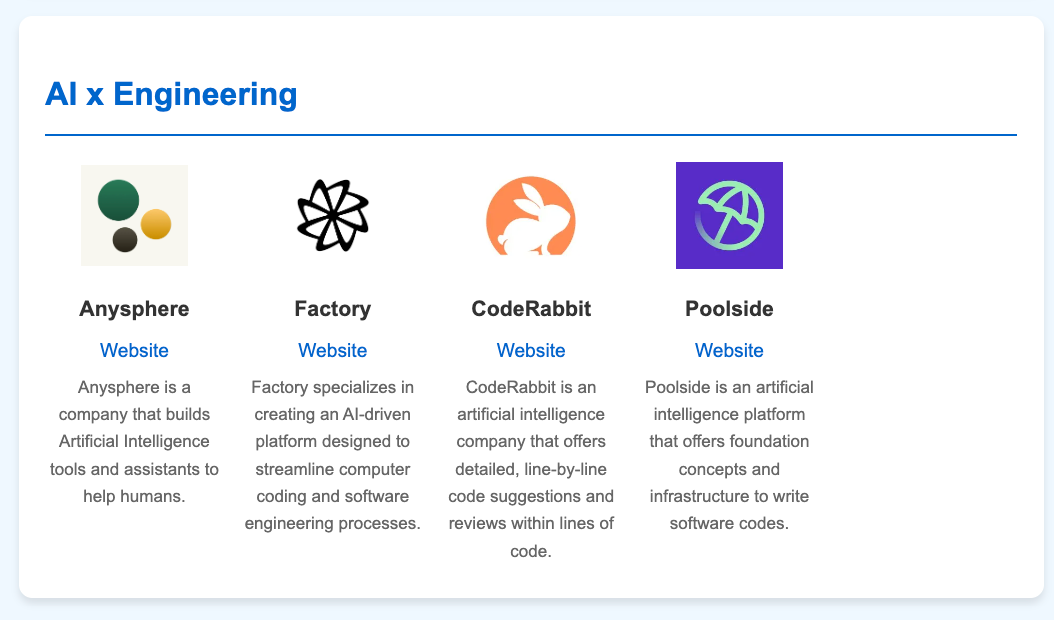

AI x Engineering

General themes:

Code generation (Anywhere — creators of Cursor, Factory, Poolside)

Code review (CodeRabbit)

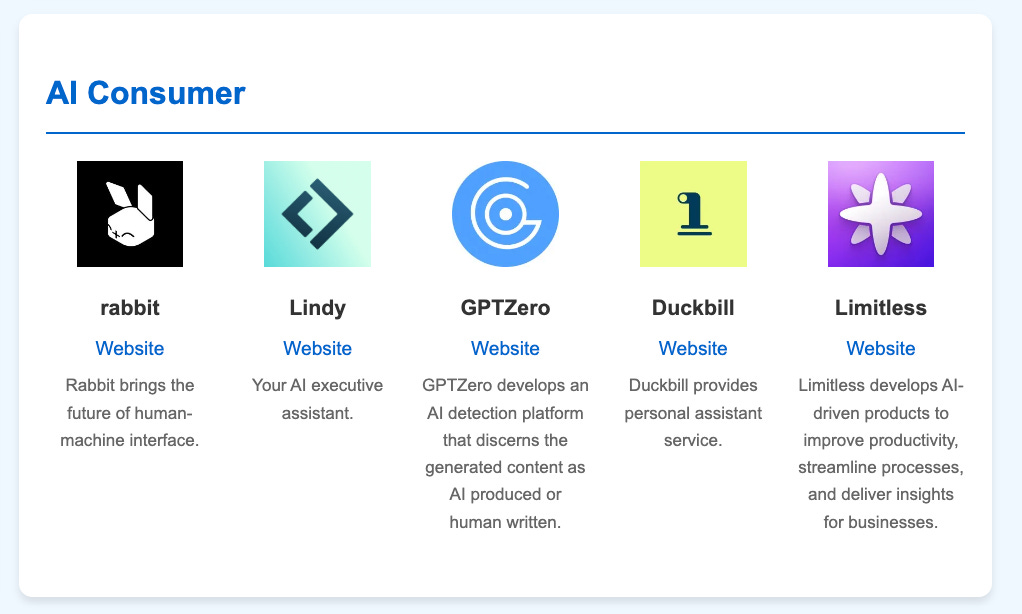

AI x Consumer

General themes:

Conclusion & Key Takeaways

While we’re still in the early stages of applied AI, it’s clear there will be huge winners.

Looking at the data, there were some high-level themes that jumped out —

Success in verticalization: Over the past two years, we’ve seen a surge in sector-specific AI across almost every industry. This strategy has been supported by real revenue numbers (e.g., Harvey), and I believe underlines the general trend towards domain expertise in AI. Looking ahead, I imagine we’ll continue to see the fight to be the “go-to AI solution” for any one category. And we’ll see the same dynamic for embedded AI solutions tailored to specific organization functions (e.g. AI tools for Sales organizations)

The play for enterprise: There's been a pivot towards enterprise-focused AI, with startups targeting the large, $100K+ contracts. If you click through the websites on the market map website, this will become clear very quickly, with the word “Enterprise” in the tagline in a lot of them. This makes sense. All enterprises are thinking about AI adoption, and startups are hoping to be the category winner as well as win in any buy-it vs. buy-it conversation.

APIs as core infrastructure: What really struck me, looking at the companies in the “AI foundational models and infrastructure” category, is how many of the companies’ APIs are powering both individual consumer apps and acting as core infrastructure within massive organizations. We’ve got ElevenLabs and Mistral AI used for pet projects, also pulling in millions of dollars with enterprise contracts. All of these APIs have lowered the barrier to entry and make shipping anything simple. But while the business model is working, is it long-term sustainable when all you have to do is swap out an API key?

Data activation: One of the big things that has come with this AI revolution is the focus on unstructured data and the emergence of new processing and retrieval techniques. Every organization has realized it has a lot of data lying around — and that data can be used for business insights or within workflows. Simply, the emphasis is not just on the collection but also on ‘activation’ — transforming and improving data processes, embeddings, and pipelines with the new AI lens.

The rise of code generation: While this category has fewer companies in it than the others, it’s one of the most significant. Code generation is one of the only things that has seen true product-market fit in this cycle. As someone who uses Cursor every day, I still can’t get over how powerful it is.

While there is a lot that is “working,” I’ve also been thinking about what’s not working — are there verticals where adoption isn’t moving as fast? What about tools? Is the next wave more agentic adoption?

It’s clear we’ll see consolidation in some areas and more break-out companies in others. As that duality plays out, so do two truisms: (1.) We’re in an AI hype cycle, and (2.) so many of these AI companies are solving real problems and creating tangible value.

This article has ended up way longer than expected. So will cut myself off here — but thank you for reading!

I’m an investor at Chapter One, an early-stage venture fund that invests $500K - $1.5M checks into pre-seed and seed-stage startups.

If you have any questions on the data, or if you’re a founder building a company, please feel free to reach out on Twitter (@seidtweets) or Linkedin (https://www.linkedin.com/in/jamesin-seidel-5325b147/).