Analysis of YC's Latest W24 Batch

We are a week away from YC’s demo week! And you can already feel things heating up — teams have been heads down for an intense 12 weeks and are ready to showcase their products, while investors are frantically lining up meetings to find the best talent.

And, as always, the data is interesting. What are the latest trends? What are the compositions of the founding teams?

We’ve got the answers.

I’ve analyzed the W24 batch and summarized the key insights from the data. It’s a week early, but I’m going to press send on this report with the idea that most of the companies are already listed on the website.

Key takeaways

YC’s latest W24 batch includes 240 companies.

A significant portion of the companies have some AI component, with 63% tagged as “Artificial Intelligence” — a notable increase from 51% in the preceding S23 batch and 29% before that.

Nearly half (47% of the companies) have at least one team member with an advanced degree (Master’s or Ph.D.), while a slight majority (52%) include a founder with a computer science background.

The majority of the companies – 58% – have two founders.

58% of the batch is based in San Francisco.

The data is collected from the YC’s website, and the founder's data is from LinkedIn. If you’re interested in the full list of companies, check out this spreadsheet: YC Batch W24

Call to action: at Chapter One, we’re actively looking at investments in this batch. If you’re a founder we haven’t spoken to or an investor who wants to chat about trends, feel free to connect!

Batch Size

YC’s most recent W24 batch includes 240 companies.

Batch size is interesting because, notably, there was a pull-back in batch size after the winter 2022 batch. Also, I still speak to people all the time who are stunned that the YC batches have 200+ companies. We’re out of the days when the YC batches were 20 companies working out of Paul Graham, Jessica Livingston, and the rest of the founder’s office in 2005.

Category Breakdown

Not surprisingly, AI is the largest category in the batch and makes up 63% (152 total) of companies. B2B is the next significant category, with 38% (92 total) companies, followed by SaaS with 58 (24%) and Developer Tools with 18% (45 total). It should be noted that companies may be classified under multiple categories; for example, a single company could be labeled as "Artificial Intelligence," "B2B," and "AI Assistant."

Percentage of batch “AI” companies over time

Now let’s look at the percentage of AI companies over time. As said previously, in the W24 batch, 63% of the companies are categorized or tagged as “AI”. This is an increase from 51% from the last batch and 29% from the batch before.

Two things are happening here: an increase in the number of AI companies for this batch, and I am also guessing that there has been a broadening definition of what is considered an AI company.

Founding team size

The pie chart below shows the distribution of team sizes among the W24 batch. The predominant team size is two co-founders, which makes up 58.3% of the companies. Additionally, teams of three account for 25% of the total, while various other team sizes collectively make up 16.7% of the batch.

Degrees and higher education

YC puts a clear emphasis on educational backgrounds, fields of academic study, and the work experience of its cohorts. This makes sense – most of the companies are applying with just an idea and prototype, and there is some expectation to pivot during the program. Therefore, the educational background of the founding teams is a major component, with the idea that past academic success can potentially signal future success, and also, picking engineering-forward teams will make the companies more agile.

Key highlights:

47% of companies (113 in total) have a team member with a higher education degree.

38% of companies (92 in total) include at least one member with a Master's degree.

12.5% of companies (30 in total) include at least one member with a Ph.D.

7% of companies (17 in total) include at least one MBA on their team.

Alumni from MIT and Stanford represent 12% and 11% of the batch, respectively.

Over half of the teams, 52% (127 in total), have a member with a background in computer science.

Location

Expectantly most of the companies are based in the US. The second biggest category is companies that don’t have a listed location.

Drilling down specifically into cities, again, not surprisingly, most of the teams are based out of San Francisco, with SF making up 58% of the total batch.

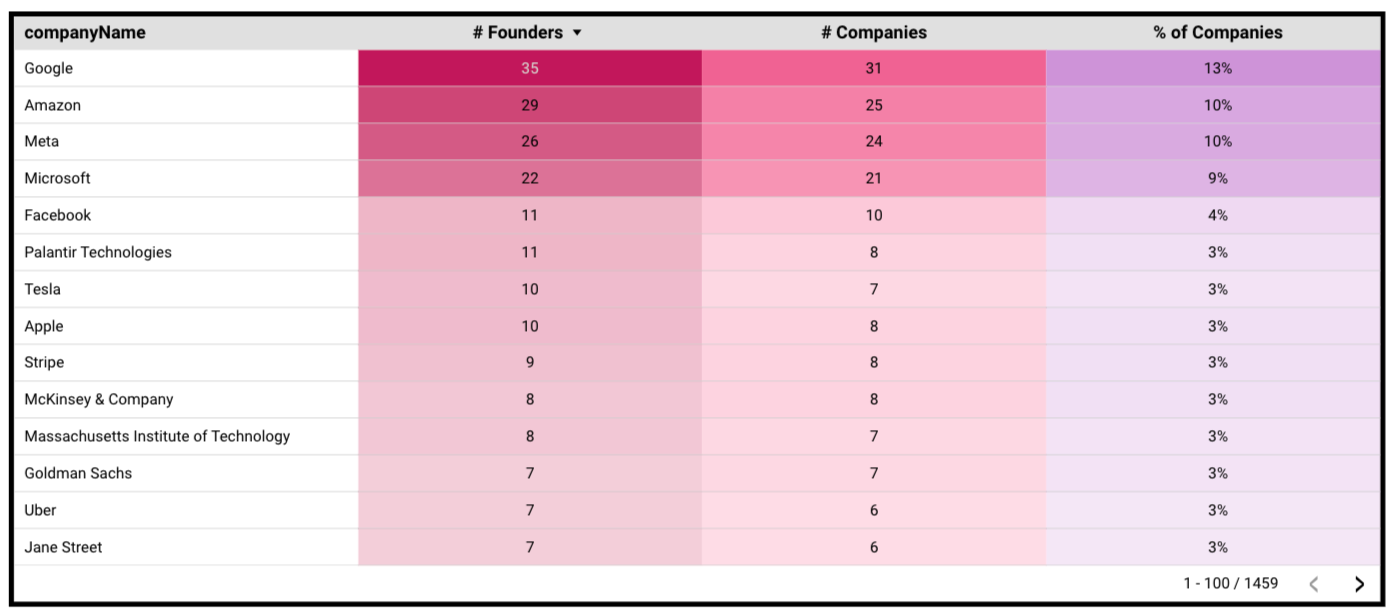

Previous work experience

Similarly to education, work experience is one of the main data points YC uses when evaluating founding teams for the accelerator. So again, it is expected that the most popular companies the founders have worked for are FAANG.

Hope this was interesting and useful! Good luck to all teams in the latest W24 batch!