I’ve found that there is something uniquely annoying about human price tickers.

During the last crypto cycle, I was in text groups where almost every $100 price movement, someone would message about it. Tweets, every day, “New high!”, “Bitcoin hit $47,000!” followed by the next hour, “Bitcoin at $47,100!” As if Bitcoin moving less than half a percent changed or proved anything.

I’m a crypto believer. I own digital assets. I work for a venture fund (Chapter One) that deploys ~1/3rd of its fund into web3 startups. I used to trade crypto full-time.

But despite my confession in the first few sentences, this article is about crypto prices.

I feel a bit cringy about it. However, I hope, to you, the reader, it’s worth something that’s beyond a human ticker because I find the data interesting.

I want to zoom out — Who are the biggest winners and losers in the past week? What tokens survived the bear? What projects haven’t done as well as expected?

I’ll start out with price charts for Bitcoin and Ethereum and then show a table and highlights from the broader market.

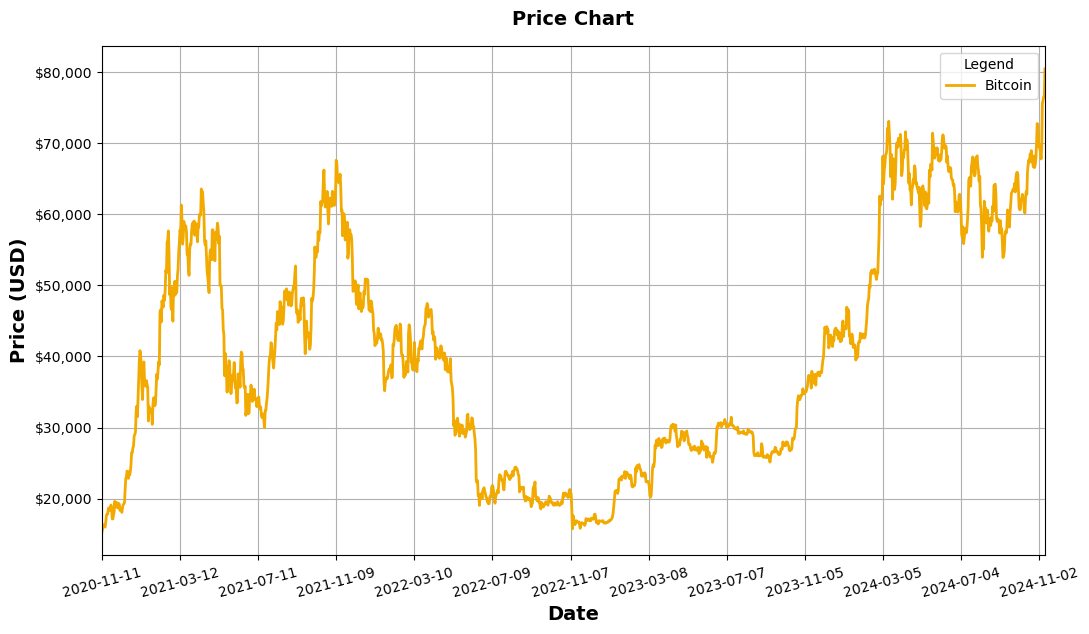

Bitcoin’s price movement

The chart below shows Bitcoin’s price movement over the past four years since the last crypto cycle. Prices collected mid-afternoon on November 11th.

Current price: $82,329

Maximum price: $82,329

Percentage moved in the last week: 21%

Percentage moved in the last year: 122%

Percentage moved in the last 4 years: 406%

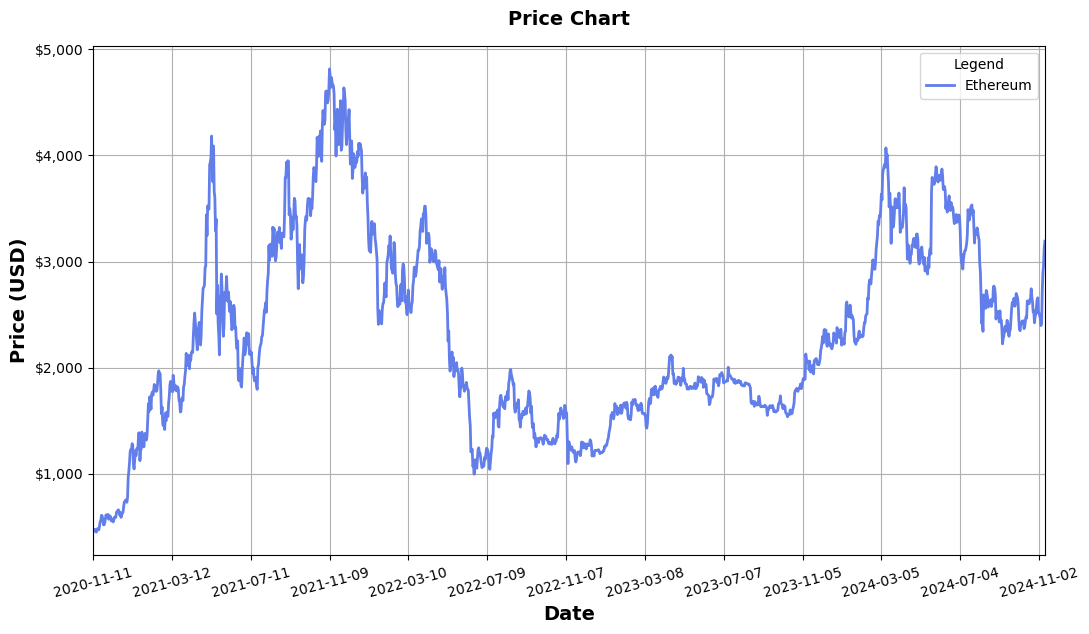

Ethereum’s price movement

The chart below shows Ethereum’s price movement over the past four years.

Current price: $3,182

Maximum price: $4,815

Percentage moved in the last week: 32%

Percentage moved in the last year: 56%

Percentage moved in the last 4 years: 588%

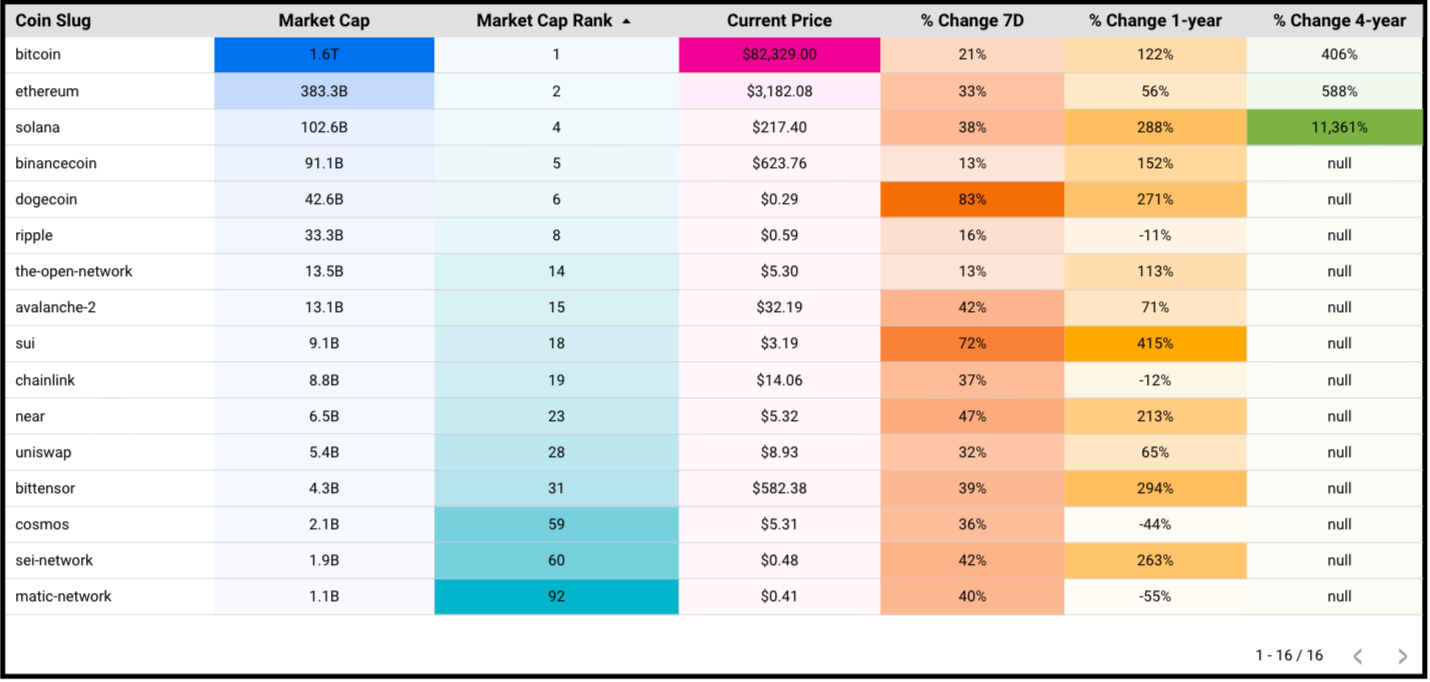

Coin price and market cap data

The chart below shows the price movement of some of the top and most watched coins.

Some things to highlight:

Dogecoin was the biggest mover in the past 7 days, with an 83% price increase. I imagine this has to do with Elon’s strong association with the meme coin and speculation about his potential role in the Trump administration.

Solana survived the FTX crash with a 228% price increase this year. My introduction to Solana was when someone told me: “You want to buy Sam’s coins. Never bet against Sam.” While this turned out, obviously, to be very far from the truth, the Solana ecosystem built through the setback and continues to grow.

Bitcoin’s price increased 122% this year, while Ethereum’s only increased 56%. Many say that this points to Bitcoin’s resiliency and dominance. I’d guess the performance gap may be related to a greater level of institutional interest in Bitcoin compared to Ethereum and Trump’s campaign promise of a Bitcoin reserve.

Final thoughts

It’s obvious the price movement was triggered by Trump’s election win.

Trump positioned himself as the “pro-crypto” candidate, and there are expectations that he will ease regulation.

But the key question is: What regulations will be eased? Who will gain from more relaxed SEC regulations? What are the actual implications? Will he create a Bitcoin reserve?

Tangled in all of this, I think, are some beliefs that people might have:

The prospect of regulation was depressing the price of Bitcoin. And now that that prospect has been removed, wider adoption will push its value higher.

The U.S. government will intervene in the market and purchase crypto, which will increase prices.

People will speculate on Bitcoin. And therefore, one should buy into the market and speculate on Bitcoin, to make money.

All these beliefs are rooted in speculation about the Trump administration and its potential and promised changes. I’d say that regardless of how the next four years play out, the recent price increases benefit the ecosystem. I’m hoping this surge will lead to a new cycle; as active web3 investors, the more people on-chain, the better.

I’m an investor at Chapter One, an early-stage venture fund that invests $500K - $1.5M checks into pre-seed and seed-stage startups.

If you have any questions on the data, or if you’re a founder building a company, please feel free to reach out on Twitter (@seidtweets) or Linkedin (https://www.linkedin.com/in/jamesin-seidel-5325b147/).